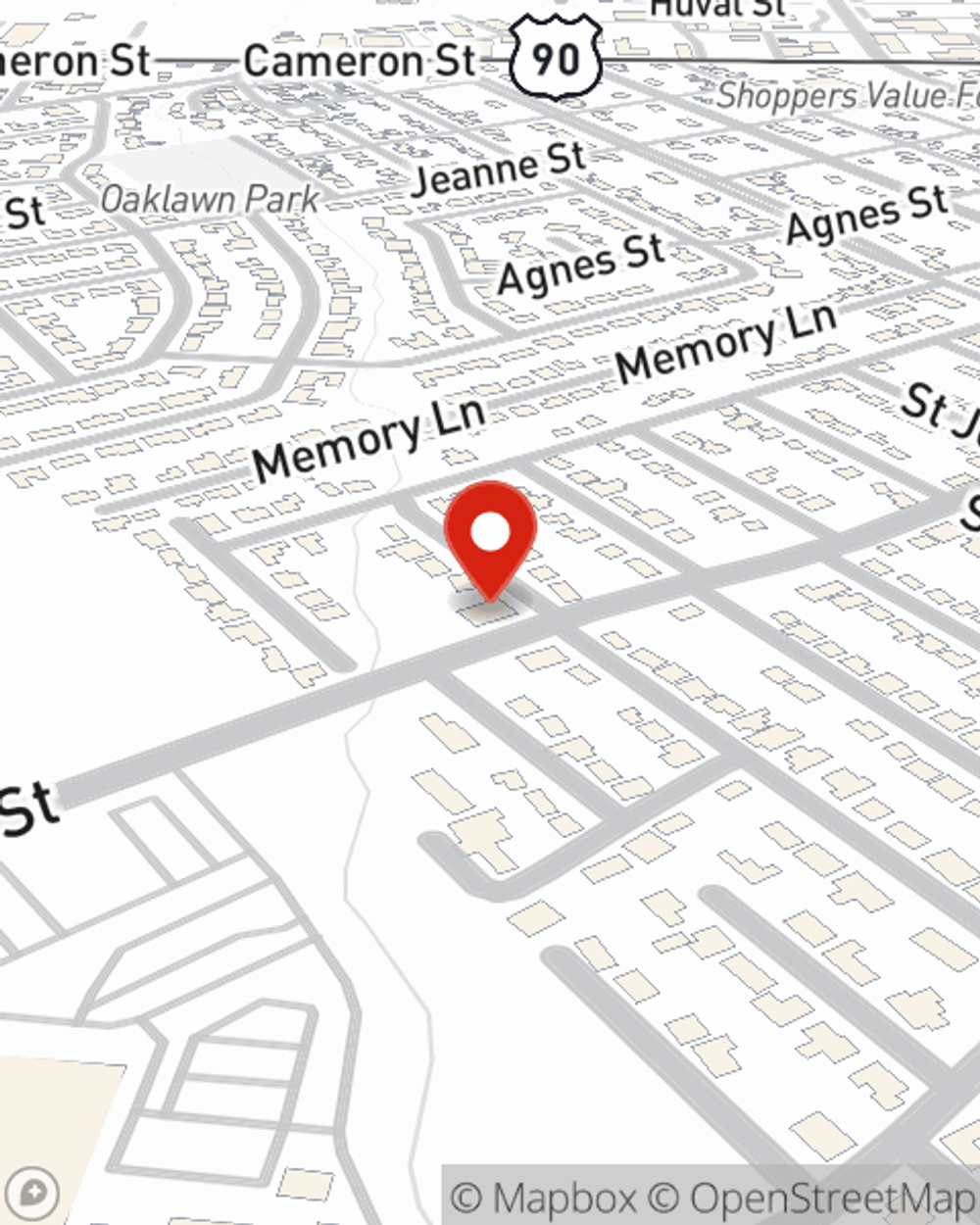

Business Insurance in and around Lafayette

Searching for protection for your business? Look no further than State Farm agent Terry Wofford!

Helping insure businesses can be the neighborly thing to do

This Coverage Is Worth It.

Preparation is key for when something unavoidable happens on your business's property like an employee getting injured.

Searching for protection for your business? Look no further than State Farm agent Terry Wofford!

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

With State Farm small business insurance, you can give yourself more protection! State Farm agent Terry Wofford is ready to help you handle the unexpected with dependable coverage for all your business insurance needs. Such personalized service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If you have problems at your business, Terry Wofford can help you file your claim. Keep your business protected and growing strong with State Farm!

Don’t let concerns about your business keep you up at night! Visit State Farm agent Terry Wofford today, and find out how you can meet your needs with State Farm small business insurance.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Terry Wofford

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.